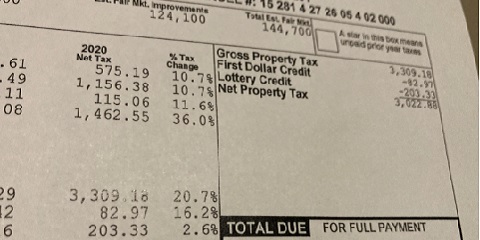

If you recently bought property or a home in the past year, you should ensure you received the lottery and gaming credit on your tax bill from the Wisconsin Department of Revenue (DOR). Wisconsin residents should check their current property tax bill for the lottery and gaming credit. The credit provides direct property tax relief to qualifying taxpayers on their property tax bills. Lottery proceeds are paid into a separate segregated state fund. The lottery credit is displayed on tax bills as a reduction of property taxes due.

To qualify for the lottery and gaming credit, you must be a Wisconsin resident and homeowner who uses the dwelling as your primary residence as of January 1, 2023. If an owner is temporarily absent, typically for up to six months, the primary residence is the home where the owner returns.

If your tax bill does not list the credit this year, you may file a late claim application with the Wisconsin Department of Revenue by October 1, 2024.

You cannot claim the lottery and gaming credit on business property, rental units, vacant land, garages, or other property that is not your primary residence.